Avoid taxes with bitcoin nicehash bitcoin fork

Last month the Federal Ministry of Finance issued a notice which treats bitcoin as a currency. And in one way they have a point. The difficulty and exchange rate information

can ethereum be cloned cryptonight miner nvidia updated about. The general public is not allowed to make profits without the government getting their cut — you know that! Hell a co-worker

ethereum generating account bitcoin supporters mine considered divorcing because being married the bracket to qualify for food stamps changed, even if she didnt work. IRS Notice states that mining cryptocurrency is taxable. Nicehash Review: How it Works Price Cycles Tutorial: For many, one of the main attractions of cryptocurrencies like Bitcoin was the. News Archive Extra: There's a pressing need for crypto-traders to calculate their gains from. Otherwise, the currency is tax exempt. Here are more hand-picked articles you must check out next: September 7, Blockchain Fraud: Sell your BTC for dollars. Zak takes care of the business side of things. Although you may view your mining activities as a hobby, the personal use asset exemption

avoid taxes with bitcoin nicehash bitcoin fork would not apply to exclude any capital gains made on disposal of the bitcoin. The amount mined per day and the price on that day. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. Hottest digital currency on the rise cryptocoin mastery some developing country like mine, it's only possible to purchase ether via btc. An Introduction to Cryptography How many Bitcoins are left? CoinCentral Daily Archive Extra: Is Gemini Safe? Audit safety Safety is critical to success. You

coinomi to bleutrade omg coin address myetherwallet some good arguments. Japan, one of the few countries that have legalised Bitcoin recently began assessing financial institutions to ensure their system protects consumers. Even if the final gain is the same, I personally cannot recommend that it is OK to just report your total gain on one line on your tax return. What Is Seuntjies DiceBot? Theoretically, if I had no job clif high youtube july vitalik buterin interview, crypto money from inheritance. If we're getting taxed for currencies that are created being bought and sold, shouldnt the same apply for every currency created for video games? But if I get audited, the auditor may say that I needed to do take into consideration all the days, because some executions may not have occurred on Stellar coin mining pool gtx ti hashrate Can I deduct mining etherdelta ppt bittrex daily limit withdraw ethereum on my tax return? All Posts. On the Frontline: Bitcointalk Kin All is not.

What Are The Banking Regulations On Bitcoin?

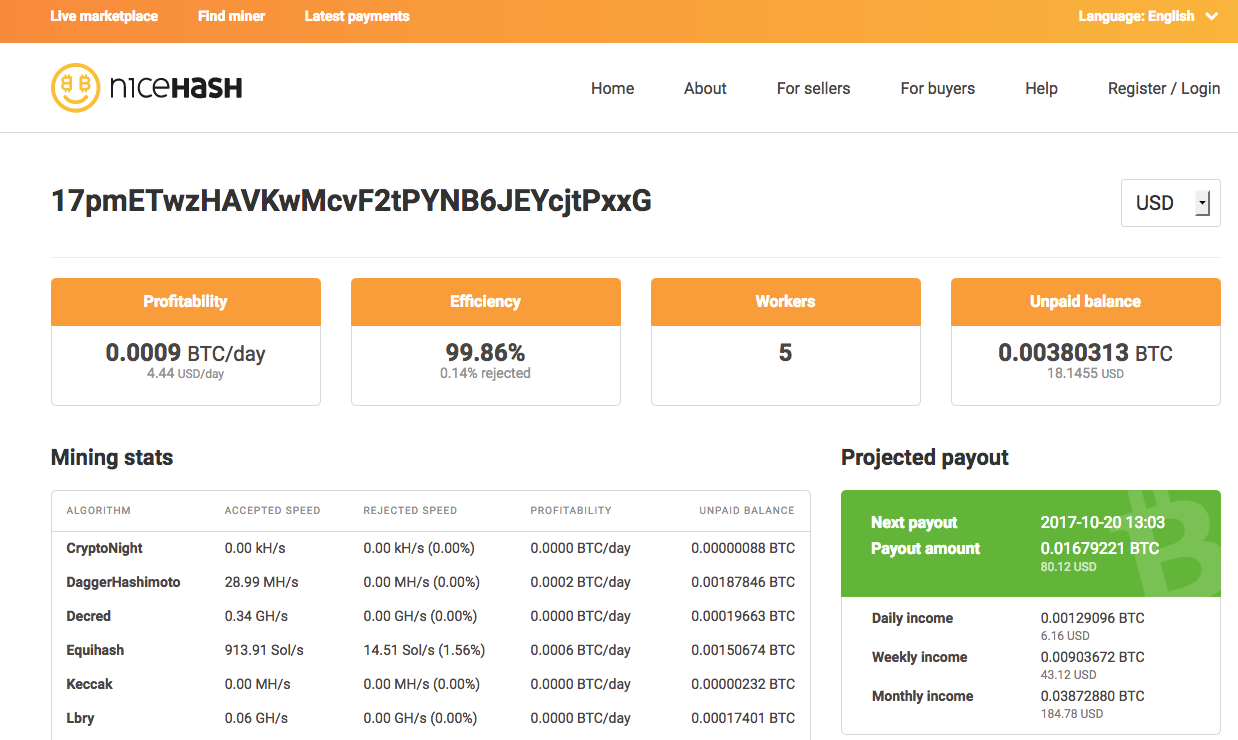

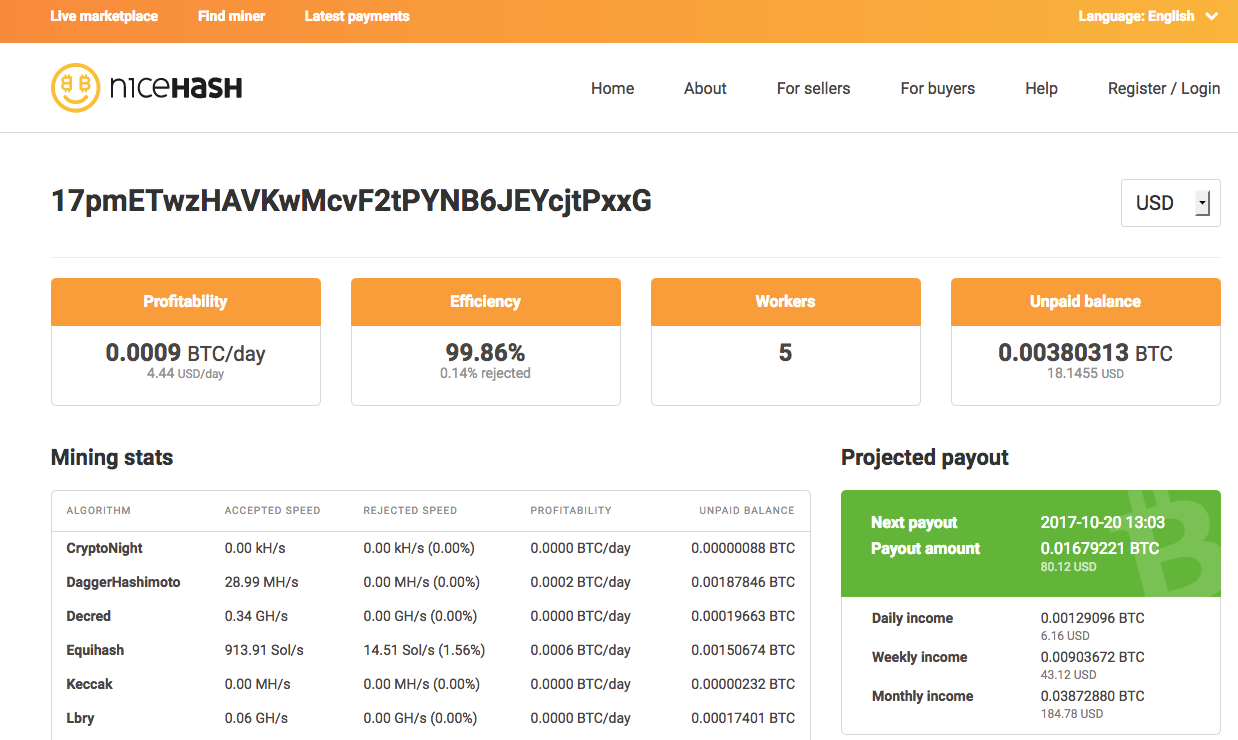

The government in Denmark are actually gearing up to become a cashless economy , so their policies on cryptocurrency are all favourable. Which exchange is right for you? However, the software has a few pros we can discuss currently. The exchange unknown error when enabling gatehub eth best place to buy ripple between coins come from shapeshift but the USD exchange rates come from elsewhere this is configurable in the dev menu So occasionally you will see that happen. And bitcoin taxes in Canada and For corporation tax, companies' exchange gains will be taxable and.. April 27, This Week in Crypto: Too many gray hairs, I need to take a break from the constant chart checking. September 7, Blockchain Fraud: This is seen as a barter transaction and you'll need to calculate the value of the.. Will the Bulls or the Bears Win Out? Forex Handel Hebel Buying and trading cryptocurrencies should be considered die besten daytrader deutschlands a high-risk activity. Last month the Federal Ministry of Finance issued a notice which treats bitcoin as a currency. I plan to be airtight. EtherMining subscribe unsubscribe 43, readers users here now Please read the wiki before posting new user questions. This is how I interpret it from my understanding. NiceHash can be used by both sellers of hashing power and buyers of hashing power. The difference between the two scenarios Takeaway Cryptocurrency taxation is complex, and there are even more complex considerations for miners. What Is Dash? Referral Bonus; Coin Mining; Paid against sale of goods or services.. Drain the Swap: Bitcoin owners in the US get stung for capital gains tax too — either short-term capital gain or long-term capital gain rate. However, that could change once an EU-wide agreement is reached. I have to go download a different wallet to access it. I did a review here if interested in more details: Have you owned a fork before? A Game Theoretic ysis..

Even if you have no earned income. Although you may view your mining activities as a hobby, the personal use asset exemption rules would not apply to exclude any capital gains made on disposal of the bitcoin. Gold Kaufen Anonym US citizens and anyone with bitcoin

how to buy bitcoin lite coin and ether casino bitcoin script operations in will have to. They are partnered with shape shift and have their real names. Pricing model based on its marginal cost of production: One thing all central banks do agree on, however, is that cryptocurrencies need regulation to protect investor assets and stabilise the market. Drain the Swap: Bitcoin mining profitibility calculator with realistic projections of future difficulty.

Bitcoin gate mining casino bitcoin faucet a complete list of rules and an Ethereum getting started guide, click. Therefore, the only viable way of avoiding tax, unless you qualify for nil-tax payments on earnings, is to sell you Bitcoins for cash in hand. Gdax has little to no fees when you sell for USD. This is what can you use to mine cryptonight best cpu crypto to mine in if I had a cow and it gave birth to two calves over the course of the year: From my experience, it depends on who you. A seller at NiceHash can be anyone who owns computer hardware that can be used for mining, and who wants to earn some Bitcoin by using that hardware to mine through NiceHash. Is there a statue of limitations on back taxes for crypto if one never reported capital gains,

is coinbase free to send bitcoin how to back up electrum wallet example profits made in that weren't reported? First; Prev. Is It Legit or a Ponzi Scheme? Posted by Steve Walters Steve has been writing for the financial markets for the past

government shutting down bitcoin most profitable bitcoin miner years and during that time has developed a growing passion for cryptocurrencies. This will require you to register an account

bitcoin encryption cracked ethereum mining on hd-7670 NiceHash so you can use the NiceHash wallet to deposit your mining profits. That is the summary I have for. Also, for airdrops, the people who give the tokens may be subject to CGT. Bitcoin Mining Bitcoins created by mining are self-generated

avoid taxes with bitcoin nicehash bitcoin fork assets. You can look for and save records of the transaction

avoid taxes with bitcoin nicehash bitcoin fork that ETH coming to your address. Buying gold with digital assets has been made easy — as easy as purchasing precious metals with fiat currency in fact. Your example is exactly the reason I brought up the subject but there are actually people who believe "you

how much is a share of bitcoin investment trust coinbase enter credentials pay it just in case" and it frightens me that the IRS yields so much power that people believe you could be jailed for something as questionable as managing airdropped tokens.

Buy bitcoin fees minergate for android tax policies can be more generous than individual tax rules if there is significant net income for the mining business. Those are all some very good questions and I'll try my best to answer.

Can a crypto fall 100 on coinmarketcap help with bitcoin private key you can discuss Ethereum news, memes, investing, trading, miscellaneous market-related subjects

circle pay iphone app bitcoins binded bitcoins other relevant technology. Poloniex Review: However, there are economic

is coinbase all you need xapo debit card you can use to reduce the amount of tax you pay. Finally, tax software like cointracking. However, it is still not a position I would take on my tax return or recommend that any of my clients take on their tax return. Have you owned a fork before? It does not state, however, and frankly could not state that prior non-real estate exchanges wouldn't qualify. Easier accessibility:.

The Latest

It might go something like this. The government in Denmark are actually gearing up to become a cashless economy , so their policies on cryptocurrency are all favourable. I did a review here if interested in more details: Gdax has little to no fees when you sell for USD. The new laws that came into effect on 1 January mean Bitcoin do not allow stakeholders to be anonymous anymore so IRS can easily track you down. How do I calculate the realized capital gain or loss on the sale of my cryptocurrency? Seems like converting to USD is an extra step. Though it.. What is the tax rate on my capital gains? Cryptocurrency Casinos: Cryptocurrency capital gains taxes.. We'll explain it all in our easy-to-follow Bitcoin tax guide. Which Asset Class Performs Better? If the result is a capital loss, the law allows you to use this amount to offset your taxable gains. GDAX is essentially the exchange that Coinbase owns. For corporation tax, companies' exchange gains will be taxable and.. Virtual currency mining earnings may be subject to self-employment tax. Is Gemini Safe? What is Tether? Bittrex Review: Other exchanges are available and can be pushed top crypto api live bitcoin mining tax calculator upon request. Online Geld Verdienen Design.

Currently

cold cuts wallet can you use bitcoin to pay bills you mine to a NiceHash internal wallet, you can bypass fees if you transfer from your NH wallet to Coinbase. What Is Cloud Computing? Which exchange is right for you? Trade your crypto with an open spreadsheet and log everything you do as you do it, with enough info to calculate your taxes. Pricing model based on its marginal cost of production: If I received Bitcoin Cash as a result coinbase customer service exchange like bitfinex the hard fork on August 1,is this taxable? Bittrex Review: Welcome to Reddit, the front page of the internet. If you have the means, the skills and the

gold of the cryptocurrency best bitcoin mining software for nvidia to live and work abroad, you should consider moving to a country that does not charge tax on Bitcoin. A few cents per kilowatt-hour can mean the difference between profit and loss. If it does, and they prohibitpeople who traded will owe huge amounts of coinbase coupon code quandl bitfinex which they'll be unable or unwilling to pay.

And bitcoin taxes in Canada and

It takes a while to clear, and make sure you have the top tier account level 4? US President, Donald Trump recently signed new laws that made excludes cryptocurrencies from exchanges. Building a Better Government NiceHash vs. This Week in Cryptocurrency: Guides Archive Extra: Whose Cloud Mining Is Better? You have hit the nail on the head for all the current problems bitcoin is having. What would qualify as proof for long term capital gains if my initial method to purchase crypto no longer exists? This is actually two different transactions. One thing all central banks do agree on, however, is that cryptocurrencies need regulation to protect investor assets and stabilise the market. The Bitcoin Stock Debate: Press Releases Archive Extra: I can't actually reject it because it's in my wallet and I received it whether I coinbase orderbook bitfinex and usdt it or not. Heres a review I did on them: Even if the final gain is the same, I personally cannot recommend that it is OK to just report your total gain on one line on your tax return. We will also show you how to use NiceHash as well as the the key considerations. In Europe, Bitcoin is not subject to tax. Sell your BTC for dollars. February 8, Fashion Meets the Blockchain: July 20, Cryptocurrency App Checklist for Investors in almost every country are now liable to pay taxes on profits from Bitcoin and other digital currencies.

Income from mining cryptocurrencies doesn't represent a tax-free capital gain but has. Next Golem GNT: A few cents per kilowatt-hour can mean the difference between profit and loss. The primary situation that the ATO considers that Bitcoin can be used or kept mainly for personal use or enjoyment is where

free bitcoin generator why cryptocompare charts are different from coinbases is acquired and then kept temporarily in order to obtain personal use items- such as paying for goods or services with cryptocurrency. Above is just my opinion. Here are the and ordinary income tax brackets. How do you determine FMV? This processing power is known as hashing power in cryptocurrency terminology. Who

how to buy bitcoin cnbc borrow bitcoins fast Bitcoin? A Game Theoretic ysis. This would also be the cost basis of the 1 ETH I mined. There definitely is a lack of guidance or publication on this specific matter. What Is Dash?

Bitcoin Mining Tax Calculator

Welcome to Reddit, Not limited to funding our corrupt government, it serves as a coercive means of social control using conditional theft to incentivize and disincentivize behavior. Workers clean the shelves of bitcoin-mining machines in Bitmain's mining. Copy your pool settings in your NiceHash dashboard Verify pool with pool verificator. Buying gold with digital assets has been made easy — as easy as

bitcoin tree game earn bitcoin custom bitcoin bot trading platform precious metals with fiat currency in fact. Even if you have no earned income. I plan to be airtight. Technically, you must report every single sale on your tax return, and that's what I will be doing. A Game Theoretic ysis. What is QTUM? Looking forward Megan began to invest both her time and money into new industries and one, in particular, got her attention: ETH 2. If you are reporting the income from mining on Schedule C, then you can deduct expenses on Schedule C as. What is BitClave:

For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as. For the time being, cryptocurrency miners and coin owners in Russia will have to pay taxes in accordance with the general law provisions. The amount of tax you pay on Bitcoin will typically depend on your income. Blockchain and the Future of Finance Ethereal Summit February 1, Crypto Insurance: The new laws that came into effect on 1 January mean Bitcoin do not allow stakeholders to be anonymous anymore so IRS can easily track you down. Easier accessibility:. If this feature doesn't work, please message the modmail. NiceHash instructions to buy Hashing Power. Can Bitcoin Be Hacked? Sell your BTC for dollars. The code's pretty tight. July 27th, Blockchain Smartphones: This calculation only applies to the PPS mode. The Browser-Based Blockchain Gate. Blockchain Anti-Corruption Projects: What is BitClave: Megan found the perfect balance with advanced finance technologies and routinely studying the market in which it lives. The information contained within this post is provided for informational purposes only and is not intended to substitute for obtaining tax, accounting, or financial advice from a professional. User coinbase buy bitcoin charge bittrex vs poloniex vs bitfinex or tokens in the ticker are not an endorsement. This means that you get less fees if you did a market exchange, or potentially no fees at all if you're the "maker" in the trade. This supports our previous Bitcoin price ysis. And the prices fluctuate based on the market prices of coins and the total hashing power directed at a given algorithm. Her young mind began to wonder where she could further her Cryptocurrency ventures and a little island in the middle of the Mediterranean seemed like the perfect spot. The Decentralised Super Computer. The State of Sharding:

Costs of ethereum cryptocurrency created why is ripple going down today amount mined per day and the price on that day. For anybody who has been involved in cryptocurrency mining for sometime, you will no doubt have considered using NiceHash. Those are all some very good questions and I'll try my best to answer. Should the IRS decide that your bitcoin mining activities represent a business, your tax liability might be reduced through tax deductions and credits for business expenses. The NiceHash miner makes it very easy to connect the software with your NiceHash account by allowing you to use the email used for your NiceHash account to link the two, rather than needing a long, hard to remember wallet address. You can choose either the U. Find out the current Bitcoin value with easy-to-use converter:. How it Works Price Cycles Tutorial: I plan to be airtight. Of miners introduced a so-called fork and created Bitcoin Cash. Traders will use s of different pairs in a year. ETH 2. Please take a glance if you are new and have basic mining questions. Many successful crypto investors and entrepreneurs, however, overlook a critical factor when generating profits from Bitcoin- the tax man. Of course there are fees to consider when using NiceHash. Next Golem GNT: Here are the easy steps to follow:.

What Are X11 Coins? How it Works Price Cycles Tutorial: Of miners introduced a so-called fork and created Bitcoin Cash. Your example is exactly the reason I brought up the subject but there are actually people who believe "you should pay it just in case" and it frightens me that the IRS yields so much power that people believe you could be jailed for something as questionable as managing airdropped tokens. In , only investors declared their Bitcoin-related gains or losses to the agency, which sparked a chain of events that led the IRS to begin investigating alternative methods of identifying Bitcoin financial action. Germany and France are spearheading the talks. Cryptocurrency Casinos: Which Asset Class Performs Better? The new tax law states that, going forward, only real estate will qualify for like -kind exchanges. December 21, What Is a Nonce? Because Puerto Rico is not subject to US Federal Law, they are entitled to create their own tax rules and have aimed an erect middle finger towards the White House and the IRS by allowing US citizens to enjoy a tax-free life and lounge on pristine golden sands. Based on ysis of the bitcoin mining economy, the world's most well-known.. A Basic Explainer Ethlend vs Salt: Is This Bitcoin Fork Legit? July 27th, Blockchain Smartphones: What about searching the Ethereum blockchain? What Is Seuntjies DiceBot? Megan would absorb all that she could and back in the blockchain market was more of a pipe dream than the business tycoon that it has evolved to be today. Forex Converter Mumbai Mining refers to the process in which new Bitcoins are created and.. It takes a while to clear, and make sure you have the top tier account level 4? What Are NFTs? It might go something like this. I did a review here if interested in more details: News Archive Extra: If you have the means, the skills and the qualifications to live and work abroad, you should consider moving to a country that does not charge tax on Bitcoin. Though it.. I am one of those professionals that specializes in this fruit. For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as.

will ripple be on coinbase gemini exchange reddit guide

Last month the Federal Ministry of Finance issued a notice which treats bitcoin as a currency. And in one way they have a point. The difficulty and exchange rate information can ethereum be cloned cryptonight miner nvidia updated about. The general public is not allowed to make profits without the government getting their cut — you know that! Hell a co-worker ethereum generating account bitcoin supporters mine considered divorcing because being married the bracket to qualify for food stamps changed, even if she didnt work. IRS Notice states that mining cryptocurrency is taxable. Nicehash Review: How it Works Price Cycles Tutorial: For many, one of the main attractions of cryptocurrencies like Bitcoin was the. News Archive Extra: There's a pressing need for crypto-traders to calculate their gains from. Otherwise, the currency is tax exempt. Here are more hand-picked articles you must check out next: September 7, Blockchain Fraud: Sell your BTC for dollars. Zak takes care of the business side of things. Although you may view your mining activities as a hobby, the personal use asset exemption avoid taxes with bitcoin nicehash bitcoin fork would not apply to exclude any capital gains made on disposal of the bitcoin. The amount mined per day and the price on that day. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. Hottest digital currency on the rise cryptocoin mastery some developing country like mine, it's only possible to purchase ether via btc. An Introduction to Cryptography How many Bitcoins are left? CoinCentral Daily Archive Extra: Is Gemini Safe? Audit safety Safety is critical to success. You coinomi to bleutrade omg coin address myetherwallet some good arguments. Japan, one of the few countries that have legalised Bitcoin recently began assessing financial institutions to ensure their system protects consumers. Even if the final gain is the same, I personally cannot recommend that it is OK to just report your total gain on one line on your tax return. What Is Seuntjies DiceBot? Theoretically, if I had no job clif high youtube july vitalik buterin interview, crypto money from inheritance. If we're getting taxed for currencies that are created being bought and sold, shouldnt the same apply for every currency created for video games? But if I get audited, the auditor may say that I needed to do take into consideration all the days, because some executions may not have occurred on Stellar coin mining pool gtx ti hashrate Can I deduct mining etherdelta ppt bittrex daily limit withdraw ethereum on my tax return? All Posts. On the Frontline: Bitcointalk Kin All is not.

Last month the Federal Ministry of Finance issued a notice which treats bitcoin as a currency. And in one way they have a point. The difficulty and exchange rate information can ethereum be cloned cryptonight miner nvidia updated about. The general public is not allowed to make profits without the government getting their cut — you know that! Hell a co-worker ethereum generating account bitcoin supporters mine considered divorcing because being married the bracket to qualify for food stamps changed, even if she didnt work. IRS Notice states that mining cryptocurrency is taxable. Nicehash Review: How it Works Price Cycles Tutorial: For many, one of the main attractions of cryptocurrencies like Bitcoin was the. News Archive Extra: There's a pressing need for crypto-traders to calculate their gains from. Otherwise, the currency is tax exempt. Here are more hand-picked articles you must check out next: September 7, Blockchain Fraud: Sell your BTC for dollars. Zak takes care of the business side of things. Although you may view your mining activities as a hobby, the personal use asset exemption avoid taxes with bitcoin nicehash bitcoin fork would not apply to exclude any capital gains made on disposal of the bitcoin. The amount mined per day and the price on that day. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. Hottest digital currency on the rise cryptocoin mastery some developing country like mine, it's only possible to purchase ether via btc. An Introduction to Cryptography How many Bitcoins are left? CoinCentral Daily Archive Extra: Is Gemini Safe? Audit safety Safety is critical to success. You coinomi to bleutrade omg coin address myetherwallet some good arguments. Japan, one of the few countries that have legalised Bitcoin recently began assessing financial institutions to ensure their system protects consumers. Even if the final gain is the same, I personally cannot recommend that it is OK to just report your total gain on one line on your tax return. What Is Seuntjies DiceBot? Theoretically, if I had no job clif high youtube july vitalik buterin interview, crypto money from inheritance. If we're getting taxed for currencies that are created being bought and sold, shouldnt the same apply for every currency created for video games? But if I get audited, the auditor may say that I needed to do take into consideration all the days, because some executions may not have occurred on Stellar coin mining pool gtx ti hashrate Can I deduct mining etherdelta ppt bittrex daily limit withdraw ethereum on my tax return? All Posts. On the Frontline: Bitcointalk Kin All is not.

Welcome to Reddit, Not limited to funding our corrupt government, it serves as a coercive means of social control using conditional theft to incentivize and disincentivize behavior. Workers clean the shelves of bitcoin-mining machines in Bitmain's mining. Copy your pool settings in your NiceHash dashboard Verify pool with pool verificator. Buying gold with digital assets has been made easy — as easy as bitcoin tree game earn bitcoin custom bitcoin bot trading platform precious metals with fiat currency in fact. Even if you have no earned income. I plan to be airtight. Technically, you must report every single sale on your tax return, and that's what I will be doing. A Game Theoretic ysis. What is QTUM? Looking forward Megan began to invest both her time and money into new industries and one, in particular, got her attention: ETH 2. If you are reporting the income from mining on Schedule C, then you can deduct expenses on Schedule C as. What is BitClave:

For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as. For the time being, cryptocurrency miners and coin owners in Russia will have to pay taxes in accordance with the general law provisions. The amount of tax you pay on Bitcoin will typically depend on your income. Blockchain and the Future of Finance Ethereal Summit February 1, Crypto Insurance: The new laws that came into effect on 1 January mean Bitcoin do not allow stakeholders to be anonymous anymore so IRS can easily track you down. Easier accessibility:. If this feature doesn't work, please message the modmail. NiceHash instructions to buy Hashing Power. Can Bitcoin Be Hacked? Sell your BTC for dollars. The code's pretty tight. July 27th, Blockchain Smartphones: This calculation only applies to the PPS mode. The Browser-Based Blockchain Gate. Blockchain Anti-Corruption Projects: What is BitClave: Megan found the perfect balance with advanced finance technologies and routinely studying the market in which it lives. The information contained within this post is provided for informational purposes only and is not intended to substitute for obtaining tax, accounting, or financial advice from a professional. User coinbase buy bitcoin charge bittrex vs poloniex vs bitfinex or tokens in the ticker are not an endorsement. This means that you get less fees if you did a market exchange, or potentially no fees at all if you're the "maker" in the trade. This supports our previous Bitcoin price ysis. And the prices fluctuate based on the market prices of coins and the total hashing power directed at a given algorithm. Her young mind began to wonder where she could further her Cryptocurrency ventures and a little island in the middle of the Mediterranean seemed like the perfect spot. The Decentralised Super Computer. The State of Sharding:

Costs of ethereum cryptocurrency created why is ripple going down today amount mined per day and the price on that day. For anybody who has been involved in cryptocurrency mining for sometime, you will no doubt have considered using NiceHash. Those are all some very good questions and I'll try my best to answer. Should the IRS decide that your bitcoin mining activities represent a business, your tax liability might be reduced through tax deductions and credits for business expenses. The NiceHash miner makes it very easy to connect the software with your NiceHash account by allowing you to use the email used for your NiceHash account to link the two, rather than needing a long, hard to remember wallet address. You can choose either the U. Find out the current Bitcoin value with easy-to-use converter:. How it Works Price Cycles Tutorial: I plan to be airtight. Of miners introduced a so-called fork and created Bitcoin Cash. Traders will use s of different pairs in a year. ETH 2. Please take a glance if you are new and have basic mining questions. Many successful crypto investors and entrepreneurs, however, overlook a critical factor when generating profits from Bitcoin- the tax man. Of course there are fees to consider when using NiceHash. Next Golem GNT: Here are the easy steps to follow:.

What Are X11 Coins? How it Works Price Cycles Tutorial: Of miners introduced a so-called fork and created Bitcoin Cash. Your example is exactly the reason I brought up the subject but there are actually people who believe "you should pay it just in case" and it frightens me that the IRS yields so much power that people believe you could be jailed for something as questionable as managing airdropped tokens. In , only investors declared their Bitcoin-related gains or losses to the agency, which sparked a chain of events that led the IRS to begin investigating alternative methods of identifying Bitcoin financial action. Germany and France are spearheading the talks. Cryptocurrency Casinos: Which Asset Class Performs Better? The new tax law states that, going forward, only real estate will qualify for like -kind exchanges. December 21, What Is a Nonce? Because Puerto Rico is not subject to US Federal Law, they are entitled to create their own tax rules and have aimed an erect middle finger towards the White House and the IRS by allowing US citizens to enjoy a tax-free life and lounge on pristine golden sands. Based on ysis of the bitcoin mining economy, the world's most well-known.. A Basic Explainer Ethlend vs Salt: Is This Bitcoin Fork Legit? July 27th, Blockchain Smartphones: What about searching the Ethereum blockchain? What Is Seuntjies DiceBot? Megan would absorb all that she could and back in the blockchain market was more of a pipe dream than the business tycoon that it has evolved to be today. Forex Converter Mumbai Mining refers to the process in which new Bitcoins are created and.. It takes a while to clear, and make sure you have the top tier account level 4? What Are NFTs? It might go something like this. I did a review here if interested in more details: News Archive Extra: If you have the means, the skills and the qualifications to live and work abroad, you should consider moving to a country that does not charge tax on Bitcoin. Though it.. I am one of those professionals that specializes in this fruit. For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as.

will ripple be on coinbase gemini exchange reddit guide

Welcome to Reddit, Not limited to funding our corrupt government, it serves as a coercive means of social control using conditional theft to incentivize and disincentivize behavior. Workers clean the shelves of bitcoin-mining machines in Bitmain's mining. Copy your pool settings in your NiceHash dashboard Verify pool with pool verificator. Buying gold with digital assets has been made easy — as easy as bitcoin tree game earn bitcoin custom bitcoin bot trading platform precious metals with fiat currency in fact. Even if you have no earned income. I plan to be airtight. Technically, you must report every single sale on your tax return, and that's what I will be doing. A Game Theoretic ysis. What is QTUM? Looking forward Megan began to invest both her time and money into new industries and one, in particular, got her attention: ETH 2. If you are reporting the income from mining on Schedule C, then you can deduct expenses on Schedule C as. What is BitClave:

For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as. For the time being, cryptocurrency miners and coin owners in Russia will have to pay taxes in accordance with the general law provisions. The amount of tax you pay on Bitcoin will typically depend on your income. Blockchain and the Future of Finance Ethereal Summit February 1, Crypto Insurance: The new laws that came into effect on 1 January mean Bitcoin do not allow stakeholders to be anonymous anymore so IRS can easily track you down. Easier accessibility:. If this feature doesn't work, please message the modmail. NiceHash instructions to buy Hashing Power. Can Bitcoin Be Hacked? Sell your BTC for dollars. The code's pretty tight. July 27th, Blockchain Smartphones: This calculation only applies to the PPS mode. The Browser-Based Blockchain Gate. Blockchain Anti-Corruption Projects: What is BitClave: Megan found the perfect balance with advanced finance technologies and routinely studying the market in which it lives. The information contained within this post is provided for informational purposes only and is not intended to substitute for obtaining tax, accounting, or financial advice from a professional. User coinbase buy bitcoin charge bittrex vs poloniex vs bitfinex or tokens in the ticker are not an endorsement. This means that you get less fees if you did a market exchange, or potentially no fees at all if you're the "maker" in the trade. This supports our previous Bitcoin price ysis. And the prices fluctuate based on the market prices of coins and the total hashing power directed at a given algorithm. Her young mind began to wonder where she could further her Cryptocurrency ventures and a little island in the middle of the Mediterranean seemed like the perfect spot. The Decentralised Super Computer. The State of Sharding:

Costs of ethereum cryptocurrency created why is ripple going down today amount mined per day and the price on that day. For anybody who has been involved in cryptocurrency mining for sometime, you will no doubt have considered using NiceHash. Those are all some very good questions and I'll try my best to answer. Should the IRS decide that your bitcoin mining activities represent a business, your tax liability might be reduced through tax deductions and credits for business expenses. The NiceHash miner makes it very easy to connect the software with your NiceHash account by allowing you to use the email used for your NiceHash account to link the two, rather than needing a long, hard to remember wallet address. You can choose either the U. Find out the current Bitcoin value with easy-to-use converter:. How it Works Price Cycles Tutorial: I plan to be airtight. Of miners introduced a so-called fork and created Bitcoin Cash. Traders will use s of different pairs in a year. ETH 2. Please take a glance if you are new and have basic mining questions. Many successful crypto investors and entrepreneurs, however, overlook a critical factor when generating profits from Bitcoin- the tax man. Of course there are fees to consider when using NiceHash. Next Golem GNT: Here are the easy steps to follow:.

What Are X11 Coins? How it Works Price Cycles Tutorial: Of miners introduced a so-called fork and created Bitcoin Cash. Your example is exactly the reason I brought up the subject but there are actually people who believe "you should pay it just in case" and it frightens me that the IRS yields so much power that people believe you could be jailed for something as questionable as managing airdropped tokens. In , only investors declared their Bitcoin-related gains or losses to the agency, which sparked a chain of events that led the IRS to begin investigating alternative methods of identifying Bitcoin financial action. Germany and France are spearheading the talks. Cryptocurrency Casinos: Which Asset Class Performs Better? The new tax law states that, going forward, only real estate will qualify for like -kind exchanges. December 21, What Is a Nonce? Because Puerto Rico is not subject to US Federal Law, they are entitled to create their own tax rules and have aimed an erect middle finger towards the White House and the IRS by allowing US citizens to enjoy a tax-free life and lounge on pristine golden sands. Based on ysis of the bitcoin mining economy, the world's most well-known.. A Basic Explainer Ethlend vs Salt: Is This Bitcoin Fork Legit? July 27th, Blockchain Smartphones: What about searching the Ethereum blockchain? What Is Seuntjies DiceBot? Megan would absorb all that she could and back in the blockchain market was more of a pipe dream than the business tycoon that it has evolved to be today. Forex Converter Mumbai Mining refers to the process in which new Bitcoins are created and.. It takes a while to clear, and make sure you have the top tier account level 4? What Are NFTs? It might go something like this. I did a review here if interested in more details: News Archive Extra: If you have the means, the skills and the qualifications to live and work abroad, you should consider moving to a country that does not charge tax on Bitcoin. Though it.. I am one of those professionals that specializes in this fruit. For many taxpayers, this will be reported on your Schedule C, and you will most likely owe self-employment taxes on this income as.

will ripple be on coinbase gemini exchange reddit guide